The current situation for imported automobiles

According to the statistics of the General Department of Vietnam Customs, in the first 6 months of 2020, the volume of completely built-up (CBU) cars of all kinds reached more than 40 thousand units, down 45.9% year over year. In which, cars less than 9 seats were more than 30 thousand units, decreased by 44.2%; trucks were over 7.3 thousand units, down 56.6%.

Particularly, in April 2020, the number of CBU cars imported to Vietnam fell sharply to just more than 4 thousand units, equivalent to a decrease of 59.5% in volume compared to March 2020. Value of imported cars in April decreased by US $ 430 million, a decrease of 40% compared to the previous month. The number of CBU cars in May 2020 was no better with 4.8 thousand vehicles imported in total, comprising nearly US $ 109 million which continued to drop by 1.1% in volume.

Number of CBU cars in the first months of 2020

Source: VIRAC, GDVC

Explanation for the decline in imported cars

The negative impact of the COVID-19 outbreak on the global economy in general and Vietnam in particular has pressured people to spend less. Due to the pandemic, many customers temporarily put aside buying cars to save money or invest in other channels like gold. In the near future, during the seventh lunar month, or “the hungry ghost” month, the auto market will be even bleaker.

While car demand has decreased, disruption of supply chain affected has also resulted in a series of suspended car factories abroad. Some car manufacturing and assembling factories in Vietnam temporarily halted production under the strategy of the parent company abroad, showing the difficulties the automobile industry will face. In the midst of the Coronavirus outbreak, the governments of many countries are increasingly adopting sweeping measures, including full lockdowns and completely sealing their borders, making the import and export clearance harder than ever.

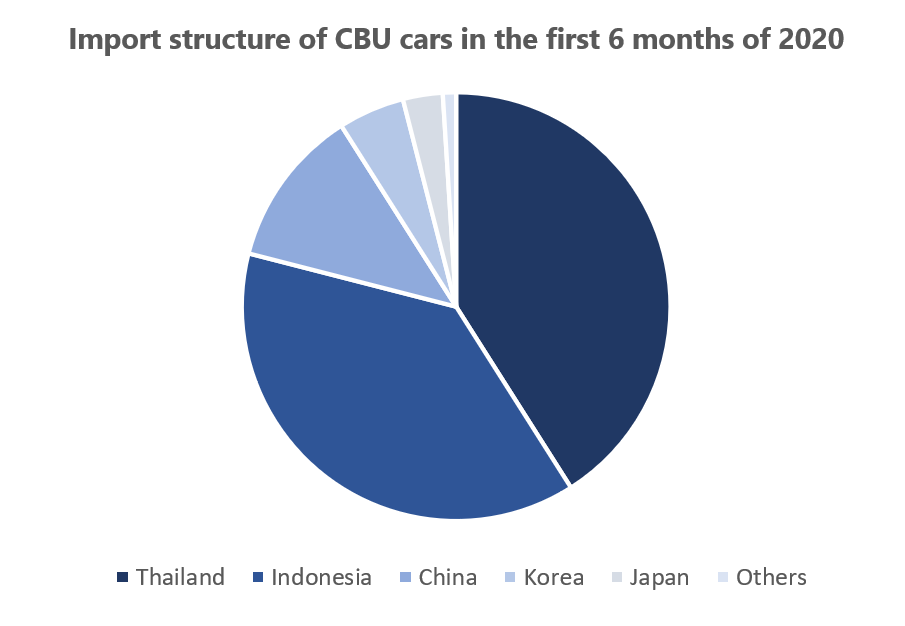

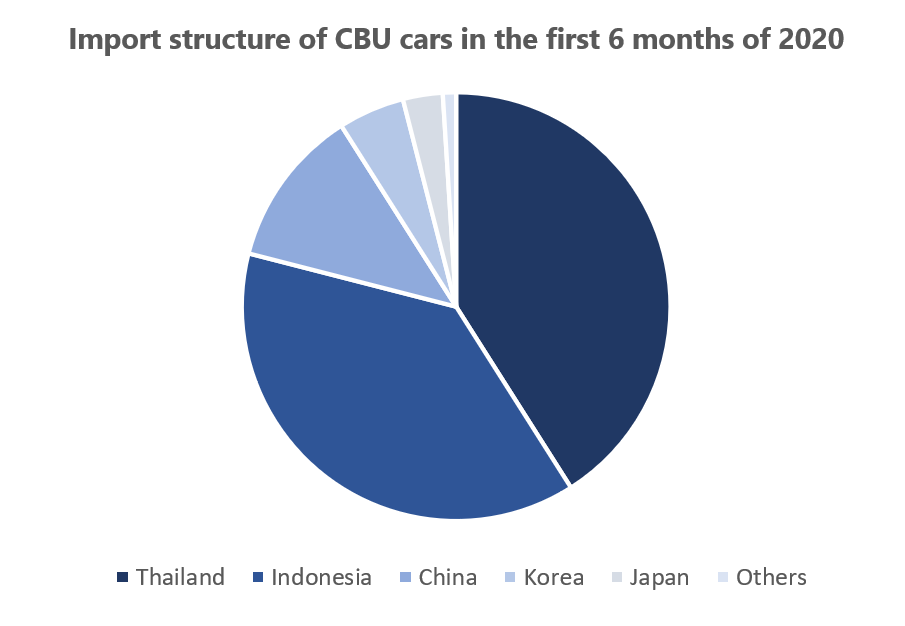

Main automobile import markets

In the early 2020, Vietnamese businesses have imported many cars of diverse origins. But a large turnover is still brought on by 5 main markets: Thailand, Indonesia, China, Korea and Japan.

According to the General Department of Vietnam Customs, Thailand is still the number one country to import cars from Vietnam. From the beginning of the year to the end of June, our country imported nearly 16,000 cars from Thailand, with a total turnover of nearly US $ 341 million. Meanwhile, the volume of cars imported from the Indonesian market is nearly 15.8 thousand units with nearly US $ 201 million in turnover. Thus, the two Southeast Asian markets accounted for nearly 79% of the country’s total imported cars in the first 6 months of the year with an output of more than 31,000 vehicles.

Source: VIRAC, GDVC

Compared to cars manufactured in other countries, cars assembled in Thailand and Indonesia to Vietnam (with an intra-ASEAN localization rate of more than 40%) have an advantage thanks to the zero tax rate. According to the ASEAN Trade in Goods Agreement (ATIGA), the prices of cars become relatively cheap compared to imports from other countries. Therefore, since the end of 2018, these two major suppliers still dominate the automobile market, even during the pandemic period that causes imports to decline.

Currently, the automobile market is highly volatile, prices are falling in all segments due to abundant supply from imports, as well as unsolds from domestic production. Automobile manufacturers are proposing many discount solutions to boost exports and reduce inventories.

The trend of shifting cars from importing to assembling domestically

Decree 70/2020/ND-CP is officially applied with the content of 50% reduction in registration fee for domestic manufacturing and assembling vehicles from June 28 to the end of 2020. The application purpose is not only to stimulate consumption for domestically produced products and promote the automobile industry, but also help maintain a balance between assembled and imported vehicles in the circumstance of all the best-selling brands benefiting from the 0% import tax rate from ASEAN.

With this policy, domestic manufacturers such as Vinfast with 100% domestically produced cars, TC Motor, Thaco Truong Hai, Toyota, Ford … will take advantage of the decree. Cars are not eligible for the 50% discount on the registration fee mentioned above. Therefore, many car manufacturers are moving from importing to assembling and manufacturing to enjoy the incentives that only last for a few months.

In the imported vehicle market, there are quite a few new models of imported cars, mostly old names that are well-known in Vietnam. Meanwhile, many models with high sales such as Toyota Fortuner, Honda CRV or Mitsubishi Xpander have been assembled in Vietnam. The decline of imported models can create a wave of domestically assembled cars with advantages in cost and tax rate. These products have made car prices strongly competitive and discounts more drastic.